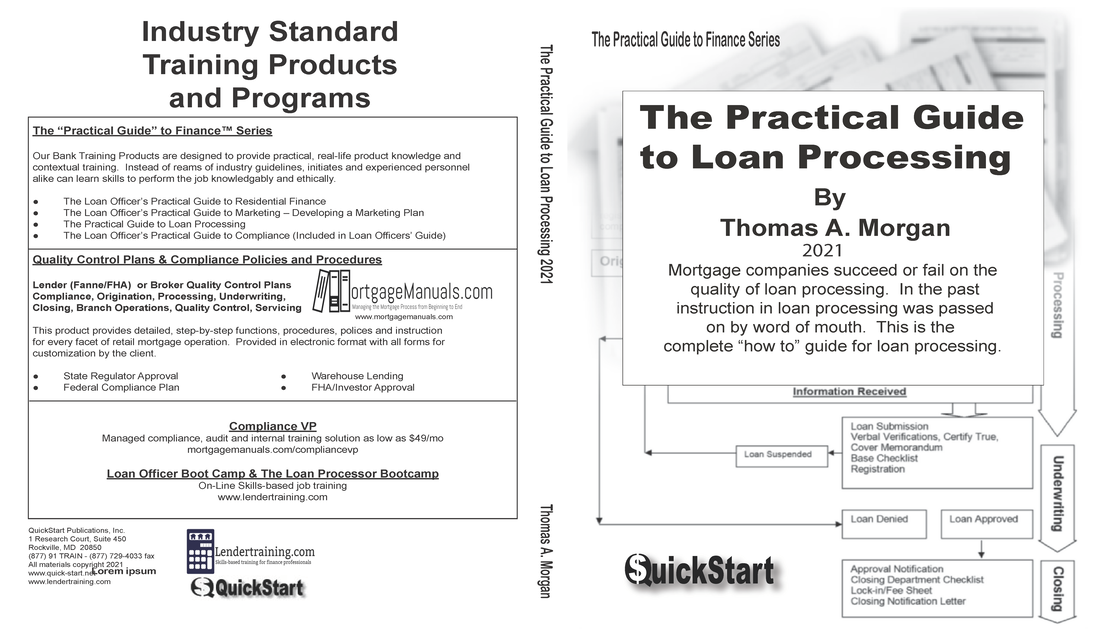

The Practical Guide to Loan Processing

|

Ordering on Amazon gives you a hard copy, but doesn't give you the included boot camp.

Purchasers from Amazon can request a $30 upgrade to include the Online Loan Processor Bootcamp. | ||||||